|

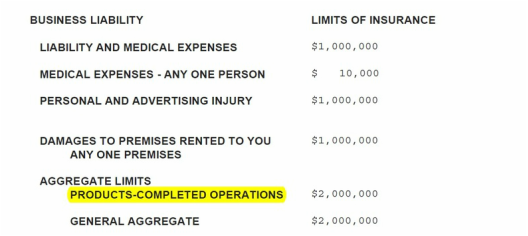

The term "Products Liability" was almost unknown to the general public and to the legal profession until recently. Today it is a widely known term applied to the liability of a manufacturer, processor or nonmanufacturing seller for injury to the person or property of a buyer. Why is it becoming more and more known? It could be due to the complexity of products for use in home, business, recreation, and other industries. Or it could be that maybe we live in a more litigious society. Either way, it's coverage that every business owner or risk manager should know about, especially if you're manufacturing a product or selling a product. In 1979, the United States Department of Commerce established The Model Uniform Product Liability Act. The reason for establishing this act was to "help to assure that persons injured by reasonably unsafe products receive reasonable compensation for their injuries. It should also help to stabilize product liability insurance rates." This act defines the scope and the various terms used in connection with products liability. It also establishes certain basic standards of responsibility for manufacturers and product sellers. It establishes the relevance of compliance or noncompliance with legislative or administrative regulatory standards. It also establishes compliance with whether or not a product is deemed defective. So, how do you obtain coverage? First, have a conversation with your agent. They will most likely have you fill out an application regarding the details of your product. Questions may range from the products intended purpose and who the end user will be. As far as the premium goes, it's going to depend largely on the overall exposure/risk and estimated gross sales. Certain products have a minimum premium, which means that is the least amount of premium to be charged by the insurance company for providing a particular insurance coverage. What if you have a policy, but are not sure whether you have coverage? Look at the Declarations Page of your Commercial General Liability policy. It will look something like this: The term "Products Liability" was almost unknown to the general public and to the legal profession until recently. Today it is a widely known term applied to the liability of a manufacturer, processor or nonmanufacturing seller for injury to the person or property of a buyer. Why is it becoming more and more known? It could be due to the complexity of products for use in home, business, recreation, and other industries. Or it could be that maybe we live in a more litigious society. Either way, it's coverage that every business owner or risk manager should know about, especially if you're manufacturing a product or selling a product.

In 1979, the United States Department of Commerce established The Model Uniform Product Liability Act. The reason for establishing this act was to "help to assure that persons injured by reasonably unsafe products receive reasonable compensation for their injuries. It should also help to stabilize product liability insurance rates." This act defines the scope and the various terms used in connection with products liability. It also establishes certain basic standards of responsibility for manufacturers and product sellers. It establishes the relevance of compliance or noncompliance with legislative or administrative regulatory standards. It also establishes compliance with whether or not a product is deemed defective. So, how do you obtain coverage? First, have a conversation with your agent. They will most likely have you fill out an application regarding the details of your product. Questions may range from the products intended purpose and who the end user will be. As far as the premium goes, it's going to depend largely on the overall exposure/risk and estimated gross sales. Certain products have a minimum premium, which means that is the least amount of premium to be charged by the insurance company for providing a particular insurance coverage.

0 Comments

|

Categories

All

Archives

February 2024

|

NOTICE: This blog and website are made available by the publisher for informational purposes only. It is not to be used as a substitute for competent insurance, legal, or tax advice from a licensed professional in your state. By using this blog site you understand that there is no broker client relationship between you and the blog and website publisher.